How long should a track record be to believe in the strategy behind it?

As a trader I’m really concerned to evaluate not only my own strategies but also other public strategies, apparently succesful. You can be flashed by wizars of the Marketing or aggressive trading that sooner or later will crash blowing out their account.

I’m continously searching how to improve my performances. Haven’t you noticed that the Hall of Fame today is different than it was a year or two, or three years ago, or even more?

How good or bad am I as a trader? Good or bad are relative concepts. To be good you have to be better than most of the people around you. Above the average. Ok… So, let’s try to go step by step.

How to measure your strategy

To be labeled as ‘Good’ we need something to measure and a score: There are hundreds if not thousands of indicators, measures, arguments, criteria, views and even opinions!; Profit Factor, Sharpe ratio, Calmar, Return DD Ratio, Expectancy, Win/Loss ratio, CAGR,… Not happy with such a mess, they are even inventing new ones as is the case of Darwinex with their own propietary ratio D-Score.

Maybe if there are so many ratios in the jungle competing to each other to measure a trading strategy. None of them is specially “good” or none of them are perfect. By the way, the ratio that proffessional investors tend to use is the Sharpe ratio. And everyone has an opinion and an endless list of argument against it. Personally, I like the Sharpe ratio.

At the end of the day we want to win money, don’t we? So I will take here the strategy performance as the only measure. Simplistic, I know, but enough to move on in this article.

Forecasting the future

Just for the sake of crunching numbers. What chances would have a strategy to make us rich? Or to make money for a living? Or just to make money enough to barely continuing trading?…

Well, I decided to make a break on my robots and crazy Forex ideas, and dive into the Darwin Universe to check for myself how is everyone struggling with the markets:

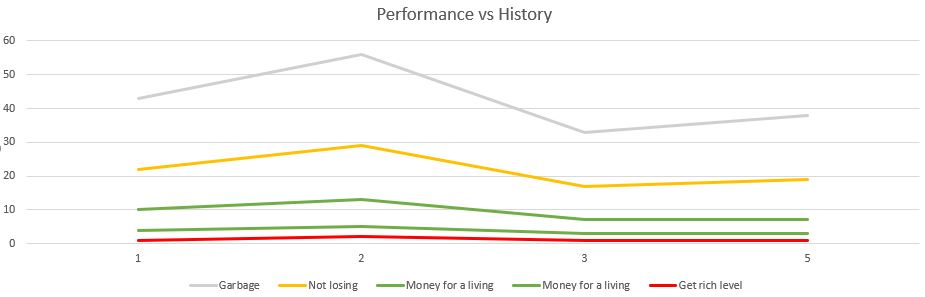

First, Darwinex sample has 3.105 active Darwins today. Good enough for my taste. Let’s move forward and play with some filters: I filtered the Darwins according its longevity – More than 1 year, 2, 3, >5 years.

After that, from those groups I checked their returns since the past 2 years. I would have preferred to measue the return since their origin but I didn’t find the way. Anyway, I think the results would be more or less the same.

This is the table with some figures:

You could argue against my personal criteria. But I think that if in 2 years you don’t get at least 10% return in total, the Strategy is worthless. I suppose that we could consider a Strategy that gives us between 10% to 20% return per year as the formula of our wet dreams. And those with more than 20% per year the Masters of the World.

On the table above:

- Chances to get a Darwin that will provide money enough for a Living: 7% to 10%

- Chances to get a Darwin that will make us rich and enjoy cocktails on a Caribean beach: 1%

On this business where everyone look like owning the definite truth but nobody knows really nothing. Getting some conclusions and cold references It’s comforting.

Conclusions

Numbers between Darwins with more than 1 year experience are quite similar to those who have a much longer longevity. In fact, after year 3, results are almost the same. So, from here:

- After 1 year your results should have confidence enough to predict the future, and after 3 years the results are pretty certain

Despite the numbers of the first year are quite close to the oldest ones, the success rate decreases from 10% to 7% on the green line (=Money for a Living). This is a 30% decrease from year 1 to year 5. Which means that from all the candidates with more than 1 year of experience. Only 70% will remain.

Looks like 3 years is the boundary from which the numbers are really stable.

Last words

What about that 1% who is on the Get Rich Level? I think this 1% is probably just statistical noise.

So, in my opinion the Get Rich Level is just a chimera. Meaning that a performance >20% per year, year after year… Not feasible.

Pingback: How much history – Part II - Professional Trading