Or when to kill a strategy.

One of the worst decisions to make for a trader is to kill one of his strategies. What can lead you to do that?

If we have a methodology to put a strategy to live, our method should cover when to get rid of our puppies too.

When our trading goes well everything looks good. Live is good! But when our trading stagnates, we tend to reframe every decision and get dubious about our best friends – the strategies. They make us win or lose money: Our precious money!

If you question your own ideas when red colour is looming, you deserve fall off the cliff. Stop trading because red is as natural in trading as death.

A race for the Holy Grail

Analysing our trading we focus on how to get better ideas, improve our results by finding new strategies with better ratios, reduce their drawdowns, gain stability, 45 degrees curve. It’s a race for the Holy Grail.

Eventually you find something, you test it, and you decide to invest money. In my case this is a long-term investment. I design my strats for a 10 year outlook.

So, why should I sweat racking my brains to kill a strategy?

Pool with Sharks

I don’t mind to see a strategy in red losing money as a shark devouring a seal in the ocean, as long as it sticks to its parameters. However, I get anxious when any of my strategies deviates from what it’s supposed to do. Even if it wins when it should lose.

Don’t take me wrong. I do feel pain when the shark devours the seal, I can feel like the seal and even cry in pain in my drawdowns!!. But it is the shark’s nature. I know how a shark will behave and he has a role in my portfolio, same as in nature. I need him to balance the portfolio. Embrace him! Love him! Hunt with him!!

Birth and Death

Planning the death of a strategy is as important as its birth. Maybe more! A non-born strategy won’t make you lose money. A zombie strategy will punish you hard.

How many workflows, discussions, advises on internet, forums and books can you find about creating and testing a new strategy? And how many literatures will you find about discarding it? Hardly anything.

Refining the process to kill a strategy is the most difficult part of the trading. In my case, I have ended up with some extremely basic ideas. Same as in building a portfolio. I believe the KISS (Keep it simple stupid) principle is the true Holy Grail in trading.

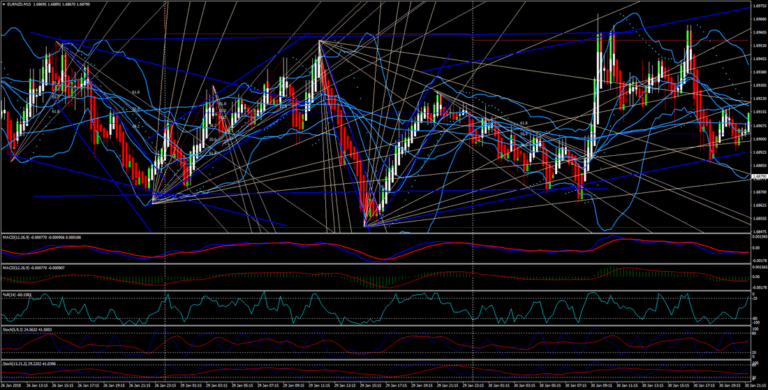

Having said that this month I’ve sent one of my EPG strategies to the morgue. I confess!