Can bitcoin prevail?

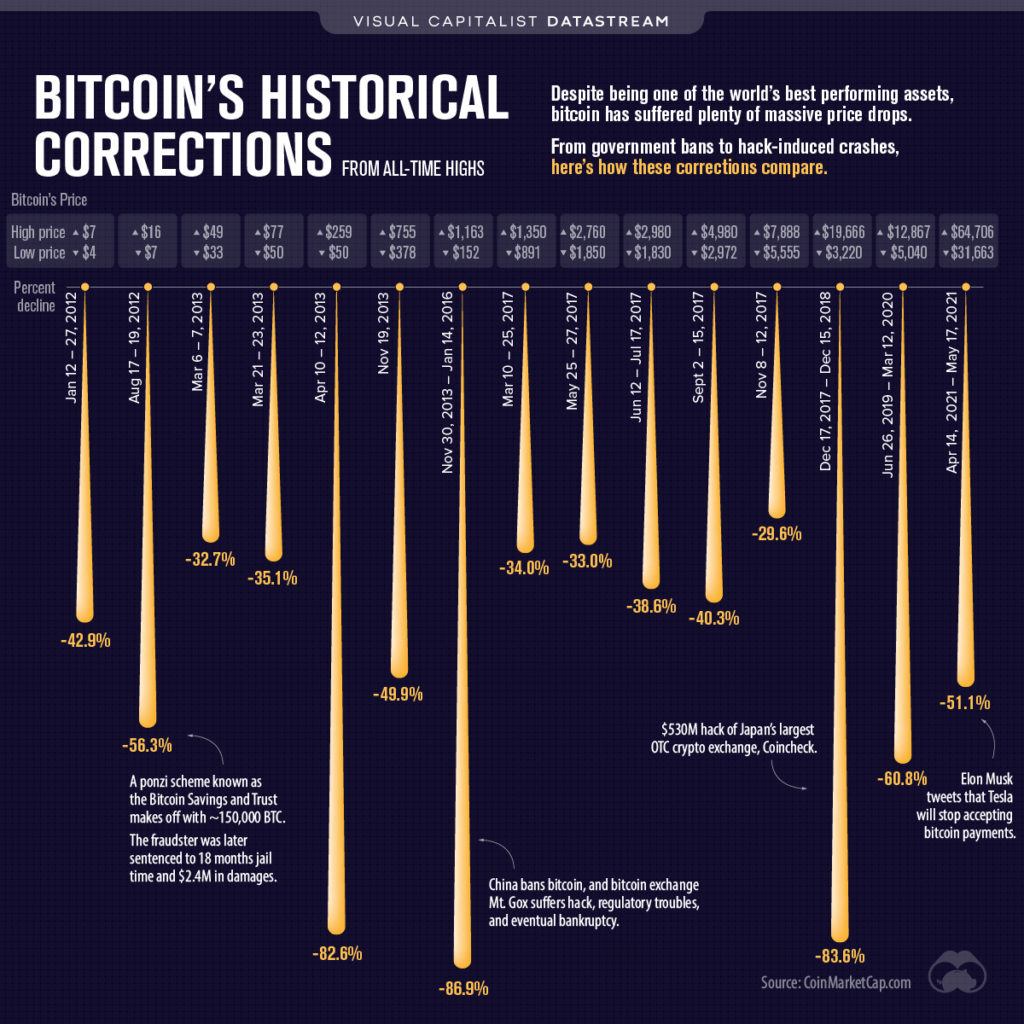

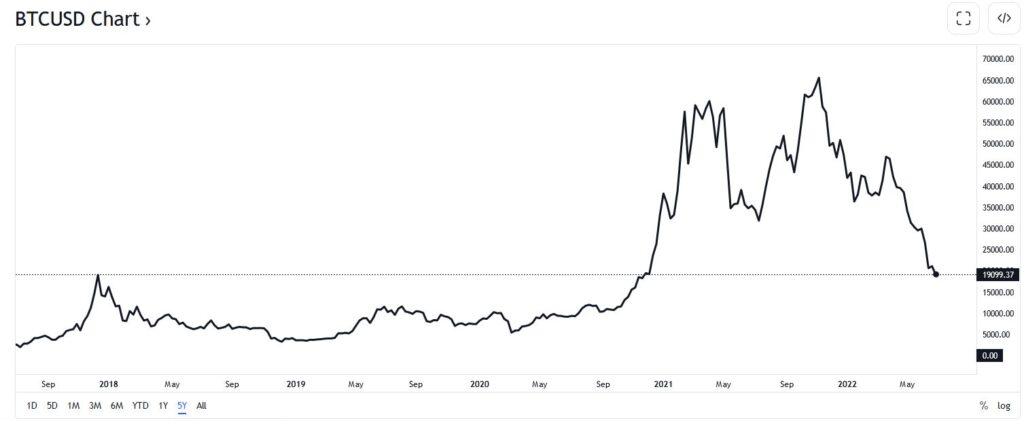

Currently bitcoin is in a bear market. If we look at the graph of bitcoin throughout its history and look at its drawdawns, we should not be so surprised seeing bitcoin to fall as it is falling now. But of course, we are talking about our money and when someone is invested and suffers a drawdawn of 80% (approx) it is almost impossible to bear.

Currently bitcoin is in a bear market. If we look at the graph of bitcoin throughout its history and look at its drawdawns, we should not be so surprised seeing bitcoin to fall as it is falling now. But of course, we are talking about our money and when someone is invested and suffers a drawdawn of 80% (approx) it is almost impossible to bear.

But What happens to bitcoin?

Lets try to analyze it rationally and relax. Ok, I return to the graphs and the situation of bitcoin in free fall is nothing new. There have been worse drawdawns, several indeed. It is an extremely volatile asset (due to its nature we might think)

On the good sight, hashrate levels are very good. Apocalypse isn’t knocking at the door as some try to make us believe saying that the miners are closing down, they are not profitable or any other divine curse:

Well, it looks pretty good to me! Hashrate behavior looks like in a pattern and based on this pattern one would expect a recovery and a very strong one!

But it’s Ok: We all know that the past doesn’t have to repeat itself and that the worst drawdawn is always yet to come. So since I don’t trust technical analysis at all either: Charts out!

Risks of the value of bitcoin falling to 0

What risks could be expected in bitcoin? Let’s remember that we are in a bear market, I want to put myself in the worst. I’m going to put aside the good things and focus on the bad:

- Lack of adoption: Nobody uses it, or very few use it. Consequently it is not practical. It’s like an electric car; the concept is good in itself but if there is no where to load its batteries, it wouldn’t have any value at all. Well, continuing with the example of the electric car; it eventually prevailed. There is a clear trend and few doubt that it is a matter of time before the electric car ends up replacing the gasoline car. Bitcoin is very young, its adoption must be progressive, logically, and it is growing in a healthy way: A micro country; El Salvador already has it as legal tender, several Nasdaq companies are heavily invested,…

- It is a Ponzi Scheme: This argument borders on the ridiculous but I read and hear it over and over again. It can’t be a Ponzi scam because no one can create bitcoins out of thin air, nor can anyone alter or control it. Where is the Ponzi scheme? Ridiculous

- Not practical as a currency: You can’t pay for a coffee with bitcoin. Not only because of the lack of adoption, but because the transactions are slow and the process cumbersome. This point does not seem like a real problem to me for two reasons at once: First; Perhaps the intrinsic value of bitcoin is not in its use as a currency but as a store of value. Same as gold; no one thinks of paying for coffee with a grain of gold. Second; If we wanted to use it as a currency, over time the technical barriers will be solved – payment modes with intuitive interfaces, network that processes faster transactions. The technical issue “only” is that; technical.

- Too volatile: Undeniable, volatility today prevents bitcoin from being considered as a currency. While I am paying for the coffee I am paying a 10% extra cost because there is a huge bearish candle. But again, as in the technical arguments, this is an issue exogenous to bitcoin. It is not part of its nature despite that right now it is being used mostly as a speculative asset. This characteristic is temporary, circumstantial. It is not part of the bitcoin foundations. Consequently, it is not a risk in itself. Volatility should decrease as it gains more adoption.

- Regulations: It has no options to prevail because the establishment will not allow it to succeed since neither the Central Banks nor the governments of powerful countries have bitcoin. A bitcoin too strong is a threat to them. No way they will allow bitcoin to succeed! A little conspiranoid but it makes fully sense. I think of the statements of Christine Lagarde, repeatedly ridiculing and attacking crypto. The establishment, the empires, the economic systems sooner or later yield, transform, mutate or disappear. Hence if bitcoin had an intrinsic value sooner or later, somehow, will prevail. Regulations could only delay the final result.

- It is a digital asset that depends 100% on the internet. What would happen if the internet disappears in a solar storm? The answer is that in this situation bitcoin would be the least of our concerns.

- Energy consumption: As of today bitcoin consumes more energy than many small countries. In a critical situation of climate change, we might think that bitcoin is not ecologically sustainable. The facts and the data are over there and they are irrefutable, but I think they are deliberately taken out of context. It is a physical law that energy is transformed; In bitcoin, the energy is transformed into security and this may be an indicator of its value. Again, bitcoin is extraordinarily secure. But it is still extraordinarily voracious. Is it sustainable? First, if it is profitable, it is sustainable for the miners; the cost of energy is less than the benefits of mining. In a free market situation, the cost of energy should rise in a situation of scarcity. Second, many miners work with green energies: Solar, volcanoes, … precisely related to the first point. No one would dream of coal mining; very anti-ecological and therefore inefficient, expensive.

- Other Blockchain Projects: Bitcoin was the first crypto but it has thousands of competitors. Most of them are Newer, more practical, faster, more private, more fancy, or in the case of the new digital currencies of the Central Banks; blockchains backed by the most powerful governments on the planet. Can bitcoin become obsolete? Absolutely not! None of its competitors have the levels of decentralization and security of bitcoin.

- It is not a store of value: That is a weird statement, so bizarre it’s hard to fight. However I’ve heard it by some crypto “experts”. Their line of thoughts is bitcoin is so volatile it can not be considered as a store of value. If that was true, indeed bitcoin would loose one of its fundamentals. Then, what’s the point of boitcoin?. Well, I don’t consider volatility as requirement to be a store of value. Can’t deny the bitcoin volatility, but volatility has nothing to do with the store of value. It is another beast, and I have talked about it some points above

- Not intrinsic value: Linking with the point above (volatility), we could think that volatility is a consequence of the uselessness of bitcoin. That is to say: Since bitcoin is not necessary, it has no function, it does not replace anything, it does not improve anything. It is only an asset to speculate. That is all! Over time it will disappear, since if it is not necessary it has no intrinsic value. Just like Dodgecoin or a memecoin doesn’t. I think this, along with the next point, are the really critical and impossible to develop in a single paragraph. Is bitcoin really necessary? Or what is the same, is it really worth something? Watch out! I do not ask if it’s worth in doing something, but if it is worth something? Its value is a measure of its need or function. Well, in my opinion, Satoshi Nakamoto’s whitepaper reflects his need. If bitcoin did not exist, it would be convenient to invent something as an alternative to Fiat money and the current financial system. But of course, this is my simple opinion that borders or falls squarely on conspiracy theories. So that; for the mainstream bitcoin has no value, therefore it would be absurd to invest in bitcoin. But, if you think the current system smells rotten, for alternative thoughts; Bitcoin does have value!. However, in countries gripped by debt or sanctions, outsider societies (Africa). Don’t you think that bitcoin is a help tool, an escape valve? I do believe it. Let’s see how El Salvador and similar experiments evolve.

- Quantum computers: This point, friends, is the only one that really bothers me. The blockchain is based on cryptography. Today it is literally impossible to crack the bitcoin blockchain. Would it take years/centuries? computing. But when quantum computing will be as popular as a Smart Phone today, bitcoin could be in serious trouble. Same as any banking system though.

Should hodlers be worried?

Bitcoin hodlers are early adopters. No one can know the future and all the raising starts have huge risks. Lots of new Projects crashed and left forgotten buried in time.

Only thing left to say is:

it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”

Warren Buffet

Of course Warren Buffet also said :

“If you …owned all of the bitcoin in the world and you offered it to me for $25, I wouldn’t take it,”

Warren Buffet