In the world of trading, finding the perfect trade is like discovering a jewel among the rocks. It is the holy grail that every trader seeks, the moment when all the pieces of the puzzle fit together perfectly.

Unleashing the Perfect Trade

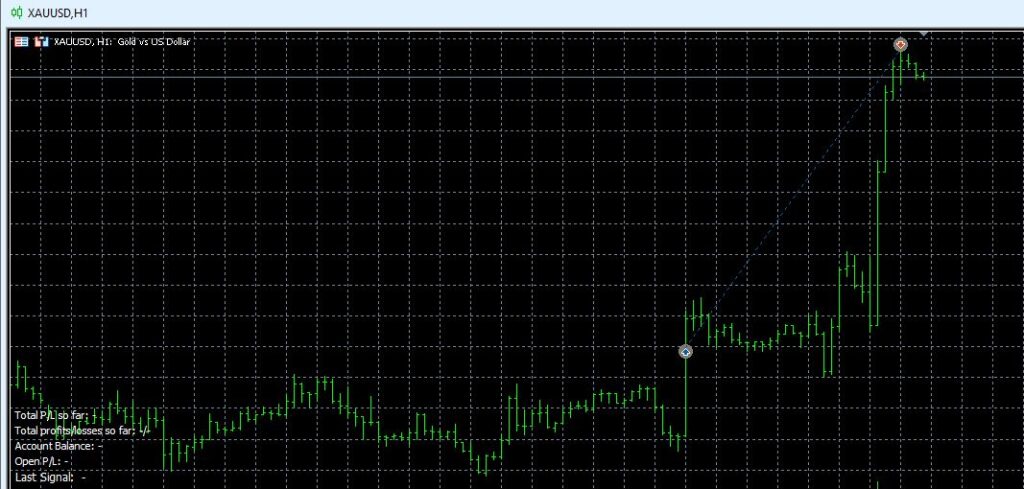

Recently, one of my most controversial robots, belonging to the group that operates in the Gold market, executed a trade that not only generated significant profits, but also dazzled with its aesthetic beauty and technical precision.

Unleashing the Power of Precision

This trade is not just an isolated event; it is a masterful example of the strategies that set the standard in the trading world. From entry price to exit time, every aspect of this trade reflects the meticulous planning and execution that characterizes true masters of the market. In this article, we’ll break down the key elements of this exceptional trade and explore the lessons we can take away to improve our own trading strategies. Get ready to dive into the fascinating world of trading and discover the power of a perfect trade.

- Entry price: All my strategies, in which I trade with my real capital at least, are Breakout strategies. Notice how it enters in a zone slightly higher than the last resistances. There is a horizontal strip with a clear zone of at least 4 points of resistance. The entry is perfect; the robot takes advantage of a very impulsive long bar.

- StopLoss: It is not visible on the chart but the trade had a StopLoss placed slightly below the resistance zone. Approximately a quarter of the entry bar. This gives the trade room to rest. Note that for almost a trading day (bars in H1) Gold was more or less sideways with a rather negative trend. There is even a strong downward impulsive bar where it seems that Gold has no more strength to keep going up. But no, my robot keeps riding on the trade with the StopLoss fixed at its starting point.

- Exit price. BOUM, very impulsive upward movement: “let your profit run” in pure form. The trade runs out of steam, loses its energy and we exit. We have succeeded with the maximum, although we would not have minded not succeeding, we just want the impulsive movement to run in our favor.

There is one more element that is not seen in the graph, which consists of trade lotting. Here my robots are very simple. They work with a fixed anti-martingale method.

Conclusion

In summary, this article examines a perfect trade executed in the gold market by a trading robot, highlighting its technical precision and aesthetic appeal. Through this example, key lessons are explored that can be applied to enhance trading strategies and unlock the potential of exceptional trades.