We say goodbye to 2023 with relief as our Darwins have suffered more than expected. So bye bye 2023. Before that! Let’s make some Balance of 2023.

We are grateful and will therefore devote some attention to the good things that have also happened. We deserve it.

In short, we celebrate saying goodbye to 2023 and embrace hopefully what the trades of 2024 will bring. And beyond trading, the rest of the Projects!

Analysis of the results for 2023

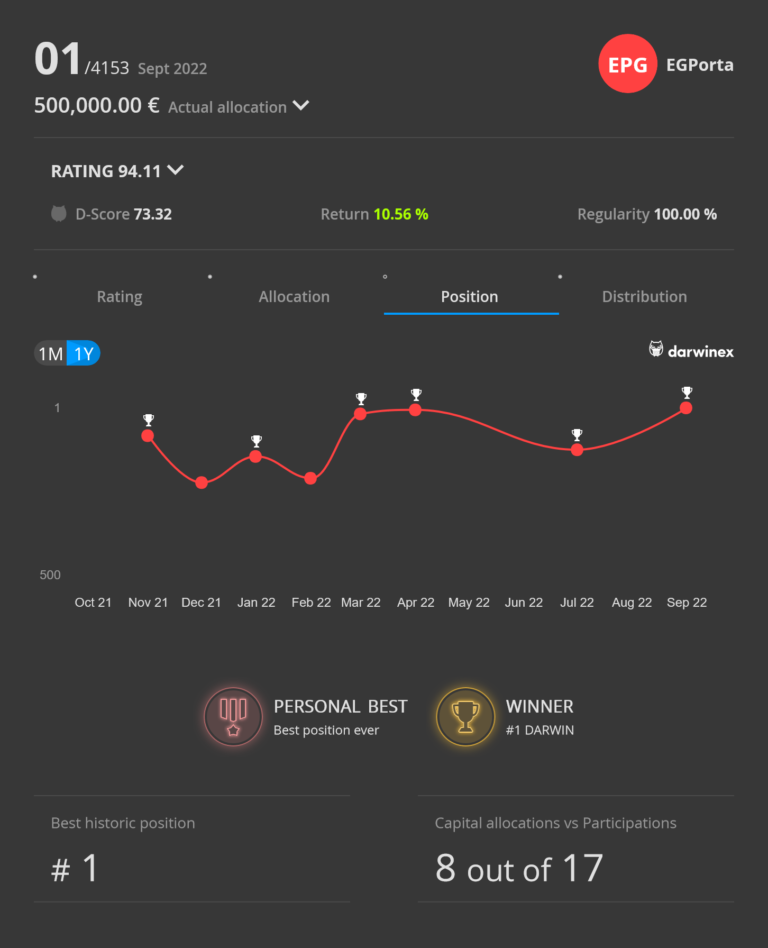

First of all, let us remember that we have 3 great Darwins on whom we projected great expectations: the prudent EPG, the fearless MIW and the wise DFO.

Sadly, all 3 Darwins have failed in 2023. It has been an unapologetic and unmitigated failure. So in our 3+ years of history, we cannot compare ourselves with the best but rather analyse how badly we have done.

Wait a minute! Of course we have. As painful as it is. Let’s compare ourselves with the best.

According to Darwinex the Darwins with the highest invested capital are: THA, SYO, JTL

We are not going to complicate things, we are going to think that the investors’ criteria is correct. We already have the 3 best Darwins on the platform. Let’s look at, and compare, the table of returns in 2023:

| Darwin | Return 2023 |

| THA | 13,26 % |

| JTL | -5,62 % |

| SYO | 5,89 % |

| EPG | -3,01 % |

| MIW | -4,72 % |

| DFO | -5,96 % |

With the exception of THA, which has a return of over 10%, we are not that far behind the rest. We even outperformed one of the Top 3; JTL which has fared slightly worse than our flagship Darwin: EPG.

However, I don’t see that any of the Darwins on display can be satisfied. By our standards, anything below 15% per year is bad.

Rest of the World

There are investments beyond Darwinex! Let’s look at how other “traditional” assets have fared. Let’s start with the least traditional of the traditional: Bitcoin.

150% return. That’s awesome! I love Bitcoin. What else can I say?

The quintessential stock market: SP500.

Almost 25%. Quite frankly good. I admit that if I had to bet at the beginning of the year I would have bet on a collapsing stock market.

And the most traditional asset of all: Gold.

13% profit. Gold being a safe haven asset is not bad either.

To sum up

| Asset | Return 2023 |

| Bitcoin | 150,06 % |

| SP500 | 24,73 % |

| Gold | 13,11 % |

| THA | 13,26% |

Conclusion

We believe it has been a bad year overall for the “classic” Darwins. And I would even say, especially bad for those Darwins heavily exposed to Forex. This last statement is more of an intuition that I have not bothered to verify.

On the other hand, we have posted in previous months that in 2023 to EPG we add a new market. This is Gold. The underlying idea was that we expected a stock market collapse in 2023 and consequently a good performance of Gold acting as a safe haven asset. This forecast did not come true and we paid for it with a few months in the red in our EPG. The last quarter Gold has performed well; also EPG.

New ideas

We have more powder, ideas for improving EPG. However, these ideas are just embryos. There is hard work ahead to refine them, backtestet them, filter them, retest them, analyse them and see if a new robot is born that can make its way into our portfolio. We will see if this crystallises into something and if this something arrives in the course of 2024. Of course, you, dear readers, will be the first to know.

Last words in 2023

I save the best for last: I would like to thank with all the strength of my heart the investors who have stood firm in EPG. Thank you very much! You deserve the best. I will do my best to make sure that in 2024 I can reward your patience, your loyalty and your diamond hands.

Happy New Year 2024!