A Farewell to EPG

Open Letter

Today, I want to openly share that the time has come for me to retire from the world of trading: I’m hanging up my boots!

In this letter —likely clumsy, impersonal, and incomplete— I not only want to say goodbye to those who have followed me or shown interest in my trading at some point, but especially to my investors. I also want to share how I got here, reflect on the journey, and explain the reasons behind my decision.

Looking Back

Long before my track record became public on Darwinex, I started trading in a rather clumsy way, programming in MQL4 and systematically losing money. Fortunately, it was never much, because I was always aware that you have to start slowly —although not with demo accounts, trading for real.

My early days were heavily influenced by the infamous book High Probability Trading Strategies by Robert G. Miner, and I went through several learning stages until the happy day I opened an account on Darwinex and created Darwin EPG, which I have been nurturing and maintaining for over five years.

My personal life has gone hand in hand with my trading. I could associate each phase of my trading with a specific stage in my life, some of which I have shared on this blog, perhaps revealing more than I should. Trading has been, without a doubt, a very intimate and personal part of my life.

The Present

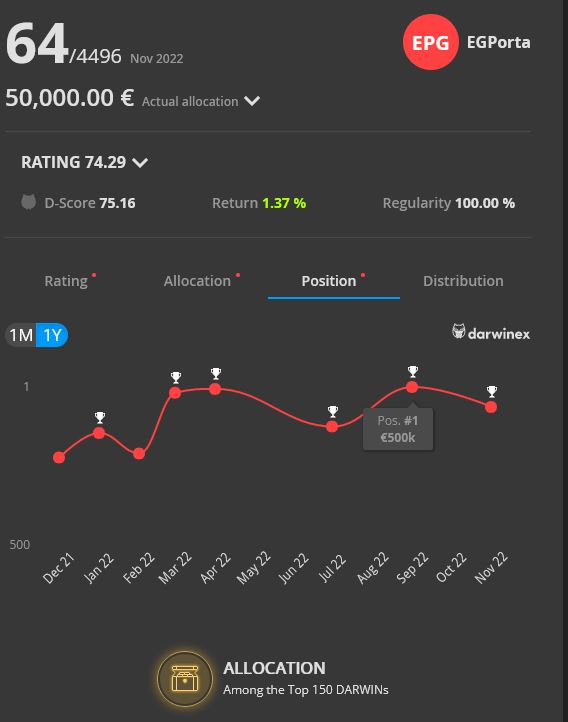

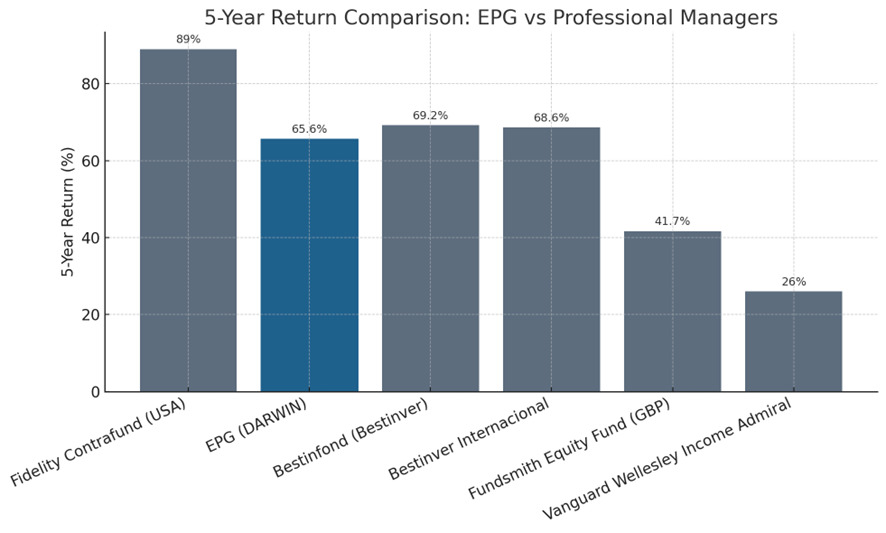

In more than five years, EPG has achieved a return of over 65%, with a CAGR of more than 10%. I can proudly say that these results alone outperform many professional managers and are comparable to well-known and prestigious funds:

| Product / Manager | 5-Year Return | CAGR Since Inception |

|---|---|---|

| Fidelity Contrafund (USA) | ≈ +89 % | ~9.7 % (since 1980) |

| EPG (DARWIN) | +65.6 % | +10.61 % |

| Bestinfond (Bestinver) | +69.2 % | — |

| Bestinver Internacional | +68.6 % | — |

| Fundsmith Equity Fund (GBP) | +41.7 % | +14.2 % (since 2010) |

| Vanguard Wellesley Income Admiral | ≈ +26 % | ~4.6 % (since 2001) |

Of course, a complete comparison would also consider volatility and other risk parameters. EPG has experienced a maximum drawdown of 17% throughout its history. I don’t have the data for the other funds at hand, but for me, this is enough.

Equally important, investors who believed in EPG have contributed over $1,000,000 in total, with more than $500,000 currently invested. Absolutely amazing!

The Turning Point

Right now, EPG is going through a very severe drawdown —and honestly, I feel this is the best thing that could have happened to me. This drawdown is a wake-up call, pushing me out of my comfort zone and forcing me to act. The day and the hour have come to put an end to this chapter.

A Message to Investors

I feel deeply grateful and honored for your trust, and I regret not being able to live up to your expectations in those cases where you didn’t achieve the returns you hoped for with EPG.

Of course, I’m open to discussing any aspect with current investors, either here on the blog or via a private message to my account. I’m at your disposal!

The End

For me, trading has never been an ego contest or a way to seek attention. It has been a challenge, a source of fun, and above all, a business.

I have proven to myself that I can beat the market and even measure up against the best —or at least many professionals. But as a business, I feel it’s no longer enough: I have been exploring other opportunities where I believe I can achieve even better returns.

I’ll remain around and maintain this blog open for some time, to share ideas and experiences, and who knows, maybe our paths will cross again in the markets.

Thank you to everyone who has followed, supported, and invested in me. It has been an incredible journey.