Another year has come to an end and it is time for the traditional balance. This year 2024 has been very good, it has had its especially intense moments so I will try to treat it with some order.

Results

First is first! Let’s analyze our results. Although I will focus on the flagship Darwin – EPG, let’s not forget that we have two good Darwins operating and contributing to our profits: MIW and DFO.

The “small” Darwins

I will analyze MIW and DFO in the same chapter. Although in my trading I devote equal time to all three; EPG, MIW and DFO. Certainly EPG is the one that leads the results and attracts investor interest.

DFO. The worst

Closing 2024 with a profit of 6% we can say without hesitation that the result is bad.

I am surprised by the bad results of DFO, this Darwin being the essence of my specially chosen robots of a Praetorian Guard. I have no explanation, the Darwin shows higher volatility than expected and very mediocre results. I will give it one more year of margin and at the end of 2025 we will decide its continuity.

After all, one of the main lessons of trading is humility. We don’t hold on to an idea no matter how bulletproof it is from our point of view. It is bulletproof as long as the market does not teach us otherwise.

MIW. Modest

Closed the year with approx. 11%. Not bad! Although honestly, I expected more. In its favor we will say that it has made important achievements:

- Attraction of capital with some DarwinIA allocations.

- Sneaking into the Gold division of Darwinex

- New All Time High in the month of October

Let’s not fool ourselves though. I would have replaced these achievements with a 15% return but anything over 10% deserves praise. The Minnows are still biting and have been able to work in coordination this 2024. Cheers to that!

EPG. The Star!

Now we go! Ladies and Gents, before you we have a Darwin who in 2024 has gained 23%. This result, in my personal point of view is VERY GOOD. I remind you what I already said about the annual returns: Expectations

In addition, it must be said that in December EPG surpassed the 25% barrier. To end the year this way would have been crazy, unfortunately December marked a severe loss of -2.65%. The worst month of the year!

But let’s put things in perspective: EPG beat its own All Time High several times in 2024 with a moderate drawdown of 7.44%. Not to mention the 23% profit. Did I say it already?

Ok, ok. My humility prevents me from boasting but things as they are: September 2024 – First place of DarwinIA price:

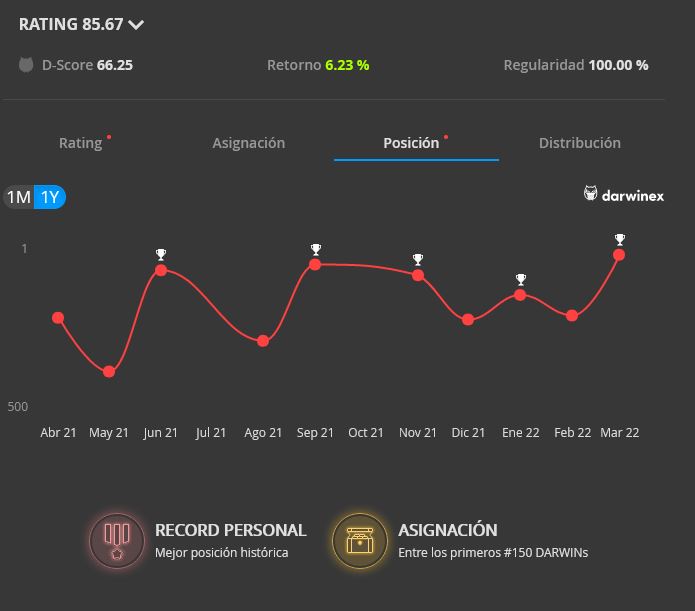

EPG is not a newcomer to win DarwinIA’s #1. In 2022 we won again, curiously in a month of September as well. Unlike the other time, in this 2024 undoubtedly the repercussion has not been so great. At first I was surprised, but I prefer it this way.

Measuring ourselves

That’s all well and good. This is all very nice but let’s stop looking at our belly buttons! So let’s see how the rest of the world has done.

Starting with the Darwinex community; more than 7,000 Darwins (I think) competing with each other; true trading geniuses, amateurs and candidates for glory. Among so much talent, we will have to choose, probably there would be as many filters and criteria as Darwins. I’m going to make it easy, I’ll choose the 3 Darwins with the highest investment on the platform. These are: THA, SYO, JTL, no one can doubt that if they are not the best they are for sure among the best of the best. Not to say that they have a history of 10, 8 and 5 years of Trackrecord. Come on, let’s go there:

| Darwin | Return 2024 (%) |

|---|---|

| EPG | 23.65 |

| THA | 4.14 |

| SYO | 14.86 |

| JTL | 3.14 |

Excellent. EPG is in a Good Shape. Let’s compare it now with other assets. Personally I prefer to look at: Bitcoin, Equities (=US500) and Gold. Let’s see:

| Asset | Return 2024 (%) |

|---|---|

| EPG | 23.65 |

| BTCUSD | 120.14 |

| US500 | 24.46 |

| XAUUSD | 26.49 |

As always, Bitcoin beats any other asset. By the way we will see what awaits Bitcoin in 2025. That would deserve not one but several articles.

Both US500 and Gold are a couple of points above EPG but hardly any distance apart. So globally: Good.

The future

There will be a change in 2025 that is already in motion as of this week. EPG will never operate in Gold again, I will develop it in the next chapter.

Otherwise, everything will remain the same. We do not intend to add anything new to EPG. Probably, by doing so we will reduce its volatility and the Home Runs with high profits will also decrease. But we may make it a quieter, duller, lazier Darwin.

One of the changes we are very pleased with is our “new” risk management. Actually not so new because we incorporated this change at the end of 2023 as a desperate measure to stop the worst drawdown in our history, and it worked! We had other measures analyzed and potentially very interesting but we did not implement them. Who knows if in the future, in a few years, we will not return to this line of analysis.

The Gold

In mid 2023 we incorporated several Gold robots in EPG; Gold Rush

As of January 1, 2025 we have removed Gold from EPG. We go back to the origins and trade only and exclusively on Forex. EPG was born for Forex.

The conclusion is that it was a mistake to get into Gold. There was a macro argument in the background but with a 100% trader’s brain I think the decision to go into Gold was not correct. As objective arguments as to why to get out of Gold I would say:

- It adds unnecessary volatility which certainly does not outweigh the benefit it brings.

- It adds complexity to EPG as I would have to apply different risk management for Gold robots compared to Forex robots. EPG I hate complexity!

- It is very unprofitable.

As in the end this is about making money. This is the actual historical % profit of Gold within EPG:

No sir, I think the idea was a good one, we gave it a try but we are out of the Gold.

For Sale

There were 5 robots in Gold, two of them have proven to work. In particular one of them I think is perfectly functional. For those who might be interested, this is the actual curve, in pips:

These are its main properties:

It should be noted that these – actual – results are based on EPG’s particular proprietary risk management.

If we want to see a backtest with the raw results over the same period, the results get a bit worse:

By the way that comparison makes me proud. EPG’s proprietary Risk management works!!!

In any case, if someone wants to buy that robot from me I will sell it for 0.005 BTC. With that deal I offer the source code in MQ5, and my commitment of exclusivity – I will sell it only once and I will never use it.

However, I am not offering my Risk management. Nor am I going to waste my time negotiating; 0.005 BTC Take it or Leave it.

Final words

Of course. Infinite thanks to EPG investors, to those who at some point have invested in EPG, to EPG followers.

I would like to post more often, although the shyness of you – readers – does not encourage me to write more often. So you know, if you want me to talk about something in particular, leave a comment or send me a private message. It will all be very welcome.

Let’s celebrate this great 2024 and let’s go for 2025 with the same energy and even more profit!