Darwin EPG

Performance and Results of my Darwins.

Year 2021 is over. Let’s wish you all a happy New Year 2022!

I love to write this post because this 2021 has been a successful year with a performance over than expected.

As said somewhere before, EPG was created thinking on the long term. First goal, to minimize its Drawdowns and secondly to get some Returns as good and consistents as possible. To do that I designed a portfolio of quite conservative strategies well balanced to each other.

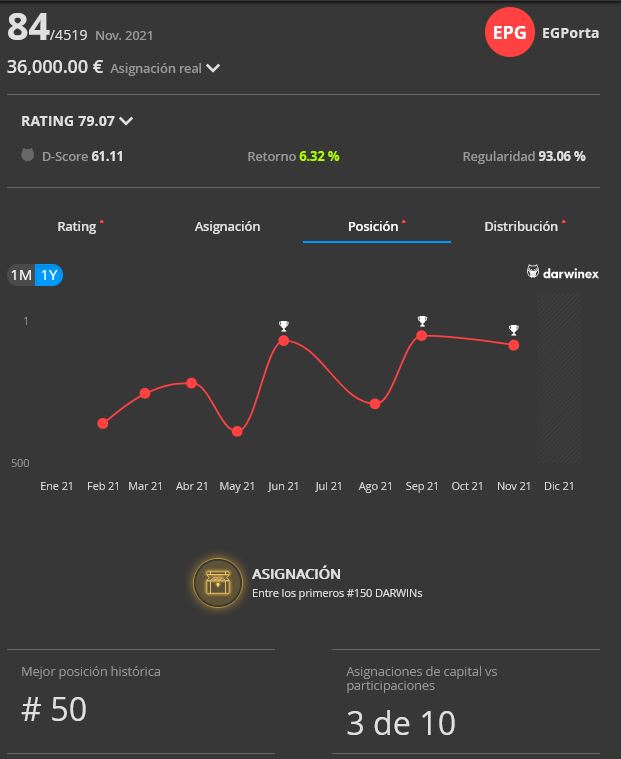

Being the EPG first full year, from beginning to end. This is how we closed the year and check how has it performed:

17% Return. Nice!!

Let’s go step by step and analyze EPG performance in detail.

Returns

Return is one of the main Goals to be closely followed. I’m expecting between 12% to 15% per year. I’d be satisffied enough with a 10% Return and I could imagine a 20% Return only in my wildest dreams. So, my 17% Return is just terrific!!

To top it off I could finish December in green. This month started quite ugly, fortunatelly on the last two weeks recovered nicely.

Investments

After all, the Performance Fees is the only way you can become a pro and trade for a living.

In this first year of existance I can not expect EPG was appealing enough to any serious investor because it is a too young Darwin. We have a long way to go to prove ourselves. However, DarwinIA is a powerful tool for the novice Darwins because it provides investment from the broker. Here, all the Darwins are competing to each other to get Darwinex funds. Any cheeky Darwin can measure itself against its fellow seniors and try to bite part of these funds.

Currently EPG is managing 120.000 € coming from DarwinIA:

Great! To be honest, I didn’t expect it on the first year. Three DarwinIA assignments on the first year is kind of amazing.

And above all, I’m very excited for my first investor. I got 5.000 € from ‘real’ investors which makes me really proud.

How Good is that?

Well, maybe these results are not so much. Sure there are Darwins over there over-performing EPG. Would we dare to compare EPG against the first class Darwins? I’m curious, let’s do it!

First thing would be to decide which are the very best top Darwins? That’s not easy at all to decide. Truth is, I have my preferences but in order to be as objective as possible let’s put aside my preferences and take the Darwinex reference. Darwinex has officially posted:

What does that mean? Looks like GFA, SYO, THA, TRO have been the star Darwins that have shine the most in 2021.

Should we dare to compare EPG agaisnt those monsters? Ok, challenge accepted! Let’s put our humble Darwin side to side to those pureblood and see the numbers:

Amazing!

- EPG has the best Return of the list

- EPG has a moderate Drawdown. Just in the middle of the list

- EPG has a low D-Score. Not the worst of the list but definitelly not a good indicator

Least we can say is that EPG has nothing to envy to the very best Darwins. Great year 2021!

Is that all?

Not really, EPG has an eldest brother: DFO. DFO hasn’t performed well at all. I am testing new approaches with DFO, looking at its results I’m far from getting the right formula. But let’s give him some room I’m optimistic about DFO for 2022

Anyway, 2021 has been a fantastic trading year. Time to celebration. Cheers!