I’ve been looking forward to posting this blog because we really have a lot to talk about!

Here we are again, this time to analyse the latest EPG Drawdown. It’s not pleasant, of course! But it’s part of this game. We are fated to experience more Drawdown days than All Time Highs so from this perspective. Let’s not panic and let our trading flow!

Now then:

Is this drawdown different from previous ones?

Do we perceive any anomaly?

When are we going to recover and taste success again?

Analysis Drawdown. The Fifth!

Indeed, in its almost 3 years of history, EPG has been chaining Drawdowns until reaching the current one, which is the fifth in its series.

Well, one more. The last one is the most painful, but the worst is always yet to come. Ok, beyond our hurt feelings and tired expressions. Let’s look at whether there is something special about this drawdown that the previous ones do not have.

The anomaly

Yes, my friends. There is one feature that worries me, that distinguishes it from the others. This is too steep a fall, I must confess I did not see it coming. In the middle of March, in a single week EPG had a very violent downward movement. I don’t care about drawdowns but this violent drop does catch my attention. EPG is designed for gentle falls and low success rates, it can experience violent movements; but always upwards. When it manages to catch a home run, it grabs hold of its prey.

And why am I particularly concerned about this impulsive downward movement? In the last few months I have been incorporating “improvements” in EPG precisely to try to smooth out its curve. I don’t mind growing slower if in return the curve is more stable.

Logically, I have gone through all the EPG robots one by one. Nothing is broken. Everything is “normal”.

So what the hell has happened? Pending a more convincing answer, I deduce that EPG will experience more impulsive movements in both directions due to the increase in lotage. The Darwinex Risk engine mitigates the violence of these moves in the Darwin. However, it does not neutralise them.

There is another possible answer: The market has changed. I don’t buy it! The market remains stable. Drawdowns are present in the backtest.

There is one more element of concern, this is the maximum DD. Today we are suffering a DD of 9%, the maximum DD we have suffered in 3 years is 10%. We are not far from exceeding that maximum.

On top of that, April has been the worst month in the whole history of EPG. So indeed folks, this drawdown is one of the worst!

Action!

There is no reason to make any changes to the robots currently in Live. They got us into this, they will get us out of the hole.

However, I have added one (1) new robot on an additional pair – USDJPY. The goal is unique: to further de-correlate the portfolio of robots that make up EPG. And I try to do this in two ways: On the one hand, I add a new pair to the previous 4 pairs. Fifth Drawdown – fifth currency pair. One more element of symmetry which, although anecdotal, is always nice.

On the other hand the new robot adds more diversity over the current generation.

What do the Backtests say?

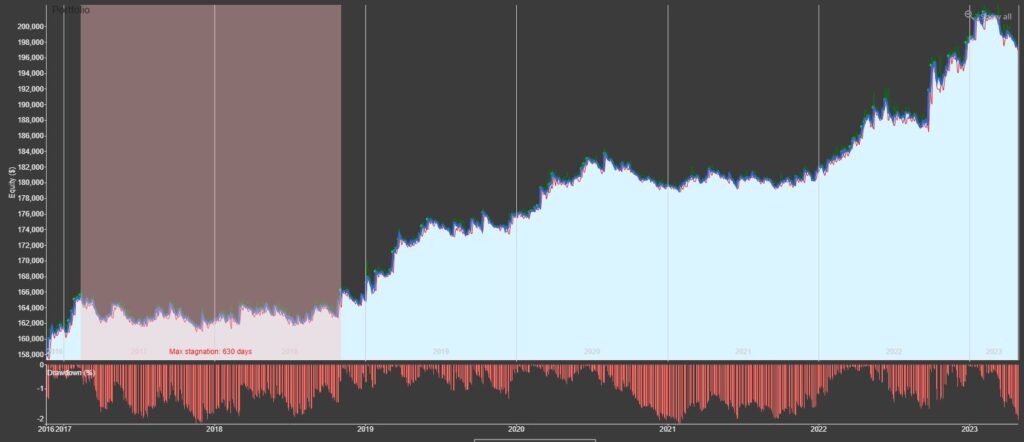

I’m sure you’ve been waiting for it! This is the curve of our backtest:

We see that in 20 years of Backtesting there is a maximum Stagnation period of 2 years.

By the way, zooming in on the last 5 years we see that the current drawdown is one of the most violent, reaching its maximum depth right now:

Diamond hands

Diamond hands

EPG in 3 years on Live has suffered a Stagnation of 8 months.

To the question “When will we recover? My conclusion is that we should not be surprised that EPG will not reach a new All Time High from September – October 2023.

I am afraid that the forecast for this year 2023 will be to finish in positive.

Of course, we will continue to work to improve EPG’s performance and make the pain of crashes less intense. But in the meantime:

Patience is the virtue of the Saints!

Pingback: I was wrong - Professional Trading