I was wrong. Time for admitting and correcting mistakes

First of all, I owe some apologies for my lack of diligence in posting on this blog. When I created this website I set myself the goal of maintaining an average of one post per month. I think it is healthy and necessary for potential investors, and above all; for current investors. Maintaining a regular communication keeping us updated about the evolution of our trading, news, reasons for concern, share joys when they come, etc..

The truth is that when things go wrong it is more difficult to expose yourself and the effort of writing is greater. And to be honest, things are going badly.

Annus Horribilis

We will remember the year 2023 as an Annus Horribilis.

Life's capacity to surprise us is unlimited

Life’s capacity to surprise us is unlimited. We are exposed to deception and betrayal in despicable ways. So yes, I was wrong in many ways. Fortunately for trading, robots are free from the emotions of a devastated heart.

In trading we continue to make a history by maintaining a negative trend that has been going on for months too long. In my last analysis of the current Drawdawn we already set a target for 2023 to finish this year at Breakeven. The truth is that either we radically change the trend or we are not even going to meet this modest target.

However, I remain optimistic and believe it is possible. This is a target that at the beginning of this year, and even more so coming out of a magnificent 2022, would have seemed pitiful. But right now finishing at Breakeven, looking at where we are now, seems like a great victory.

So if I had to bet, I would bet that we will finish Breakeven. 10% in 4 months? It’s doable!

Mistakes

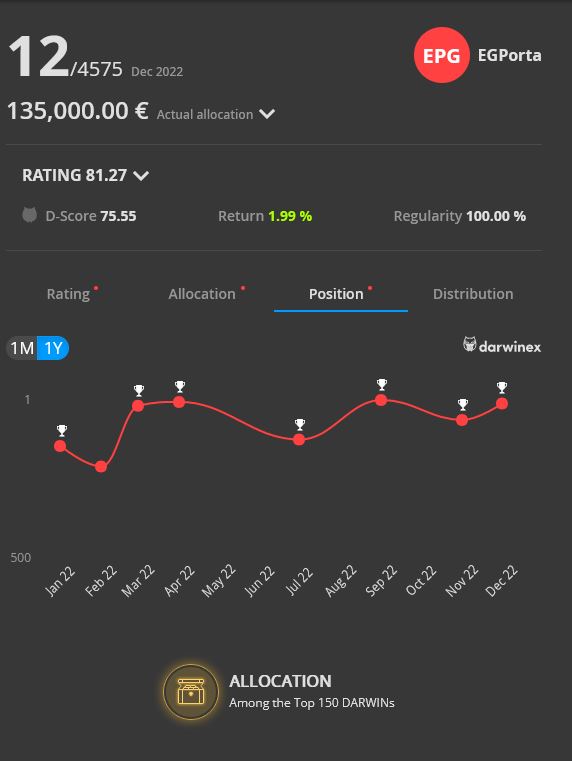

I have always believed that we should not change the philosophy and structure of EPG, I am sticking to this line, I have no doubt about it. I test any new idea to the point of exhaustion and if I decide to take it to Live, I apply it to other portfolios. This is the reason why I created Darwins MIW and DFO, which are not doing any better than EPG.

However, in EPG I am applying small improvements that I think allow either a smoother curve or more robustness. For example:

- Optimised Risk Management: I am applying a strategy based on several ideas taken from Van Tharp’s literature.

- New EA’s in the Portfolio built under the same EPG pattern.

First mistake: Gold

Unfortunately I have made a fundamental mistake that has had quite catastrophic consequences at EPG: The introduction of a new market. Besides Forex, EPG for the first time in its history started trading Gold.

As I said, this was a fundamental mistake. The basis of the error is the assumption that in 2023 the stock markets would collapse, therefore Gold as a safe haven should be in an uptrend. Consequently, I introduced 5 EA’s always trading long Gold; see the entry Gold Rush. The reality is that Gold has been behaving sideways in 2023 and these EA’s are draining a Portfolio that is already unable to sustain its own performance.

I have reduced my exposure to Gold to a minimum. I believe my Gold EA’s are good but in the current market situation they cannot deliver positive results.

Second mistake: Technical problems

I have had occasional technical problems with my VPS. There have been several weeks where the server would reset and orders would not go live or would not update or the slipagge was outrageous…

It has been insane dealing with MT5, recovering passwords, reconfiguring everything.

I finally signed up for a new VPS and have completed all the migration work. This new VPS is more powerful so technically we can say that we are now 100% covered.

Obviously we cannot blame these technical problems for EPG’s bad behaviour, but they certainly could not have come at a worse time.

Backtests

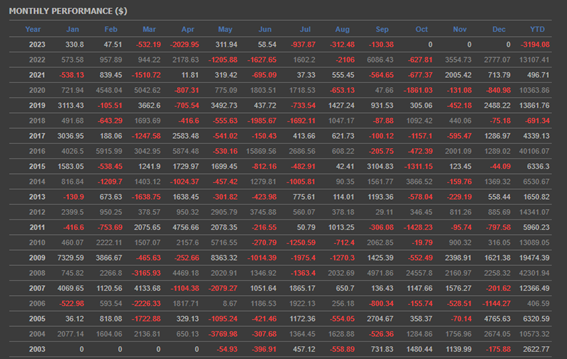

Ok. This drawdown sucks. That’s a fact. Let’s now see what the backtest of our EPG portfolio looks like, maybe it will give us a clue or just a bit of perspective about the moment we are living in:

What we see is that 2023 is indeed the worst year of EPG. The results of the backtest do not coincide exactly with the Darwin backtest because the backtest does not apply the same risk engine applied by Darwinex and because the backtest is not an exact copy of the reality since throughout 2023 we have made modifications both in some EA’s that enter and exit as well as in the Risk Management.

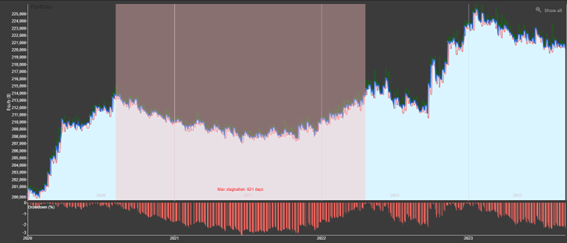

On the other hand, if we look at the Portfolio curve over the last 3 years:

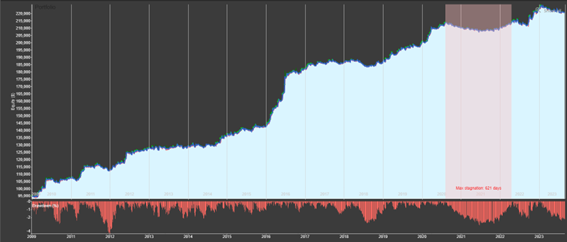

And expanding our equity for the last 13 years? There we have it:

Conclusions

I remain convinced that the concept of my Darwins – EPG, MIW, DFO – is sound. In the specific case of EPG; expanding its Backtest to a multi-year timeframe we see that visually at least there is nothing particularly striking other than the fact that we are in one of its worst darwdowns of all time (more than 13 years).

Not for nothing is it said that the worst drawdown is always yet to come. We live the proof of this reality in our own flesh.

Let’s hope that in the coming months we can close the year 2023 at Breakeven – our maximum target at the moment – and put our Annus Horribilis behind us.

¿Porqué supones nada?.

No tenemos una bola de cristal, yo parto siempre de la base que la evolución del precio de cualquier activo es impredecible.

Podemos suponer un colapso de las bolsas mundiales en octubre por seguir la tradición, que además teoricamente podría ser mucho mayor que el de 2008, pero… ¿Porqué creemos tener la capacidad de adivinar el futuro?.

Tengo amigos que me preguntan: ¿Que va a hacer la bolsa?. Mi única respuesta razonable posible es: No tengo ni puta idea. 🙂

Se quedan perplejos, si no lo sabes ¿como haces trading?.

Yo me subo al tren en marcha una vez a comenzado a moverse, no intento adivinar si se movera hacia adelante o hacia atrás. Que parece que va para adelante y se vuelve para atrás, salto en marcha de la misma forma que me subí.

Cuando yo empecé en esto, precisamente allá por octubre de 2008 escuchaba Intereconomia y por entonces uno de sus colaboradores estrella era Antonio Saez del Castillo, independientemente de que su famoso libro “Asi se gana el dinero en bolsa”, desde el punto de vista de la estrategia es nefasto, si que aprendí una cosa muy importante. Los mercados están manipulados, nosotros no somos los que los manipulamos, luego no sabemos que es lo que quieren hacer los manipuladores y solo hay tres verdades absolutas: El precio, el precio y el precio. El precio refleja en si mismo todas las circunstancias que influyen en su formación, incluidas las que desconocemos como la manipulación.

Y el precio solo puede hacer dos cosas. Subir o bajar.

Fin de la historia.

Ahora aplica la lógica para sacar beneficios a un fenómeno que no es aleatorio como seria una tirada de dados y no es aleatorio gracias a la bendita manipulación, pero para nosotros es impredecible.

Totalmente de acuerdo. Sabias palabras amigo.

Ni sabemos lo que va a pasar con la bolsa o los mercados, ni tenemos información privilegiada y además en mi caso ni tengo los conocimientos en economía que me permitirían tener una opinión fundada.

Las predicciones de colapso y hundimiento de las bolsas creo que están ahí desde que tengo uso de razón. Probablemente – voy a suponer algo más – aparecerían desde que EEUU abandonó el patrón oro por allá 1971.

Creer en la rumorología o hacer caso a los expertos en economía, para el caso es lo mismo, es un grave error que cuando afecta a tus decisiones de inversión o estratégicas tiene trágicas consecuencias = pierdes pasta.

Yo he caído en ese error añadiendo el Oro en mis robots que en este año 2023 lo están haciendo de pena.

En mi descargo me gustaría decir que todos los ingredientes de la Gran Recesión están ahí básicamente por unos Bancos Centrales totalmente idos de la olla, especialmente el europeo que parece una pandilla de burócratas borderlines. Sigo creyendo que la burbuja está a punto de petar. Pero he aprendido la lección, es una simple opinión y nada más que eso sin más valor que mi alineación del Barça ideal para el próximo partido.

Gracias por pasarte por aquí Miguel Angel

¿Porque dices que el oro lo está haciendo de pena?.

Hace lo que hace como cualquier otro activo. Y nosotros simplemente tenemos que ponernos o largos o cortos, ya está.

Sobre el estallido de la burbuja, claro que estallará como siempre ha hecho. Pero eso es normal y a nosotros no nos debería afectar.

Cuando se de el próximo crash bursátil, que no sabemos cuando será. Se supone que nosotros vamos a estar cortos en bolsa, porque vamos a hacer lo que tenemos que hacer cuando las circunstancias se dan y hasta contentos.

Los gráficos de precios son dibujitos que indican como evoluciona un activo, da igual si sube, si baja o que es lo que provoca esas subidas y esas bajadas, la acción del precio lo manifiesta todo lo conocido y lo desconocido y a nosotros todo eso nos da igual.

https://www.youtube.com/watch?v=AhIgdDylM2o&t=29s

Dear ohtuporaqui,

I trust this message finds you well. I greatly appreciate your transparency in sharing your reflections on the performance of the EPG strategy in 2023. The historical achievements of this strategy are indeed intriguing, and I am considering making an investment in it. To gain a deeper understanding, I have a few questions I would like to pose and request your insights on:

What factors contributed to 2023 being the most challenging year for EPG? It appears that the performance in 2023 differs significantly from the previous two decades. Were there any notable anomalies in the behavior of currency pairs in 2023 compared to the historical data?

In your backtesting process, did you consistently employ the same data source across the entire 20-year period?

During the backtesting phase, were any filters applied to eliminate poor trades or outliers from the data, potentially biasing the results?

Concerning the noted mistake in trading gold:

Did the 20-year backtest statistics encompass the inclusion of gold Expert Advisors (EAs), or was the mention of gold trading specific to the 2023 backtest?

If new trading ideas were tested on the other two Darwins, were the gold EAs tested on those accounts before their implementation in the EPG strategy?

The decision to invest in gold appeared to be based on a subjective judgment that the price of gold would rise, leading to the use of long-biased EAs in the EPG strategy. Can we expect future macro judgments in EPG, and if so, will they be informed by historical data and backtesting?

Notably, it seems that in 2023, EPG continued to primarily trade GBPUSD, GBPJPY, EURJPY, and EURUSD, with gold trading taking place between May and October. Are you considering the removal of gold-related EAs from EPG, or do you intend to persist with trading them within the strategy?

I look forward to your insights on these questions as they will be invaluable in making an informed decision regarding my potential investment in the EPG strategy. Your candor and expertise in this matter are greatly appreciated.

I trust this message finds you well. I greatly appreciate your transparency in sharing your reflections on the performance of the EPG strategy in 2023. The historical achievements of this strategy are indeed intriguing, and I am considering making an investment in it. To gain a deeper understanding, I have a few questions I would like to pose and request your insights on:

What factors contributed to 2023 being the most challenging year for EPG? It appears that the performance in 2023 differs significantly from the previous two decades. Were there any notable anomalies in the behavior of currency pairs in 2023 compared to the historical data?

In your backtesting process, did you consistently employ the same data source across the entire 20-year period?

During the backtesting phase, were any filters applied to eliminate poor trades or outliers from the data, potentially biasing the results?

Concerning the noted mistake in trading gold:

Did the 20-year backtest statistics encompass the inclusion of gold Expert Advisors (EAs), or was the mention of gold trading specific to the 2023 backtest?

If new trading ideas were tested on the other two Darwins, were the gold EAs tested on those accounts before their implementation in the EPG strategy?

The decision to invest in gold appeared to be based on a subjective judgment that the price of gold would rise, leading to the use of long-biased EAs in the EPG strategy. Can we expect future macro judgments in EPG, and if so, will they be informed by historical data and backtesting?

Notably, it seems that in 2023, EPG continued to primarily trade GBPUSD, GBPJPY, EURJPY, and EURUSD, with gold trading taking place between May and October. Are you considering the removal of gold-related EAs from EPG, or do you intend to persist with trading them within the strategy?

I look forward to your insights on these questions as they will be invaluable in making an informed decision regarding my potential investment in the EPG strategy. Your candor and expertise in this matter are greatly appreciated.

First of all, thank you very much xxxxx for your comments, and for posting them openly hear. Your words and my response certainly enrich this space.

You say that you are considering investing in EPG. Thank you very much! I am very honoured. However, I don’t want to dissuade you, but I think it is wise to think carefully before investing. As a matter of principle I would not invest in any instrument that is in full drawdown. It is different to deal with a drawdown when you are already in than to enter when the instrument is in drawdown. That is my Risk Management philosophy. I know this is contrary to my interests but above all I want to be honest in what I say.

I don’t want to leave any of your questions unanswered so I will go through them one by one:

What factors contributed to 2023 being the most challenging year for EPG? It appears that the performance in 2023 differs significantly from the previous two decades. Were there any notable anomalies in the behavior of currency pairs in 2023 compared to the historical data?

This is not the case. Although 2023 is one of the worst years in history, in the EPG backtest there are worse periods: With higher stagnation and higher drawdowns. There is no anomaly detected either in EPG or, in my view, in the behaviour of Forex pairs. We are going through a shitty period, that’s all. In general, other Darwins I follow that trade exclusively in Forex are suffering a lot in this 2023, so EPG has no exclusivity of a bad 2023 either.

In your backtesting process, did you consistently employ the same data source across the entire 20-year period?

Yes, of course. However, in my methodology, backtesting is just one more tool. I do not base 100% of my decisions solely on the backtest.

During the backtesting phase, were any filters applied to eliminate poor trades or outliers from the data, potentially biasing the results?

No, not at all. The robots in backtesting are exactly the same as in Live. Otherwise, it wouldn’t make any sense to backtest something with different conditions or parameters or filters than what we end up trading. So no. Any filter applied in Backtest is also applied in Live.

Did the 20-year backtest statistics encompass the inclusion of gold Expert Advisors (EAs), or was the mention of gold trading specific to the 2023 backtest?

Yes, in the 20-year backtest I also included the recent robots in Gold. Note that EPG is not a fixed portfolio, I keep adding and removing robots. The backtest I show is the 20 year backtest of the last portfolio. It would be crazy to represent the backtest with the EAs entering and exiting at each date. Actually the EPG backtest is shown for illustrative purposes. My decisions to remove or add a new EA are based on their individual backtests.

If new trading ideas were tested on the other two Darwins, were the gold EAs tested on those accounts before their implementation in the EPG strategy?

No, and the reason is the following: EPG has a different methodology than the other two Darwins. Anyway, it is not a bad idea for any EA incorporation to go through another Darwin before entering EPG. I had thought about it, however I am not convinced because the other Darwins have their own merits or demerits on their own. I don’t want to mix. I would prefer other systems like the Incubation Period, which I also don’t like and won’t apply.

The decision to invest in gold appeared to be based on a subjective judgment that the price of gold would rise, leading to the use of long-biased EAs in the EPG strategy. Can we expect future macro judgments in EPG, and if so, will they be informed by historical data and backtesting?

That’s right. The decision to enter Gold was based on a subjective decision. It was a mistake. No more subjective opinions and decisions. Never again!

Notably, it seems that in 2023, EPG continued to primarily trade GBPUSD, GBPJPY, EURJPY, and EURUSD, with gold trading taking place between May and October. Are you considering the removal of gold-related EAs from EPG, or do you intend to persist with trading them within the strategy?

I continue to trade in Gold because I am confident in the quality of the EAs I have generated in Gold. However, I apply a Risk Management that reduces the EPG exposure in Gold. In this month of October the results in Gold have picked up (this last week has been ugly though). I am in an only slightly negative situation with Gold.

Your questions and comments certainly demonstrate knowledge and passion. A pleasure chatting with you!