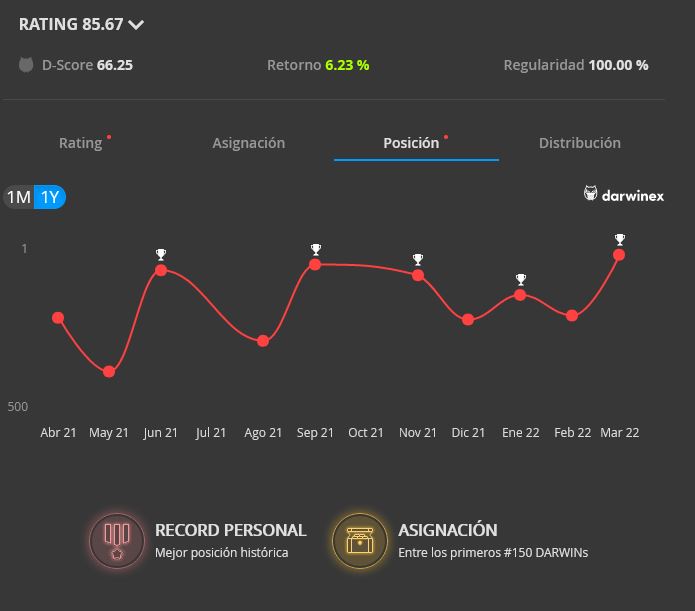

Darwin EPG

Finally I’ve decided to post some introductory words to my Darwin EPG. It’s not easy to me for several reasons. First, I think EPG has some flaws in its conception. Second, EPG has nothing extraordinary thus it’s not exceptional.

In any case, I have my skin in the game. It would be nonsense to invest in something that doesn’t worth it. I can’t understand how anyone can even consider investing in Darwins so uncapitalized, if a trader doesn’t feel like his own Darwin deserves his own money simply avoid to put money in it (wise rule). After all, it’s so cheap to play with robots in FX. How on earth an investor can even consider investing on those toys? Anyway, each one is the owner of their own decisions.

Third! EPG results talk by themselves, that should be enough introduction. Darwinex platform is fantastic, it offers all the information you need to make a good assessment.

The Mastermind

Having said that, I’ll start talking about the trader behind EPG – that’s me!

I’ve dedicated, still I am, countless hours studying the markets, looking for patterns, formulas, programming, testing, betting, reading books, following training material, you name it. I’ve passed by all the phases of the stereotype trader. It’s a long path where you walk blind and I’m in my own journey learning, discovering. To me, that’s the challenge that gets me hooked so much on trading.

I have a scientific background and I don’t consider so stupid myself, I’m a Mensa member after all! None of that is enough to win money… Or maybe yes! Some years ago I gave up all the formulas, advice, gurus, “experienced” traders on the forums and decided to follow my own rules. Some time ago, I discovered Darwinex, I loved their message and decided to create my Darwins from scratch; EPG and DFO. So far so good.

Its Foundations

EPG is built on the sound bases of: i) simplicity, ii) stability, iii) risk aversion. What I mean by that is:

- Simplicity. Ideally I want to avoid even a single indicator. But I can’t! that’s why I think EPG has flaws in its conception. One single indicator: Too complexity for my taste! Anyhow, nothing to do with those algotraders drunk on indicators, conditions, rules. Poor ones, doomed!

- Stability. Once the robot is born it should work at least for a half of the period of its backtest; 10 years. No messing around with the parameters, just let it go through all of his phases, some will win some will lose; that’s a long distance running. Now, I’m thinking on those guys who believe that market is changing every few months, or weeks, or influenced by mooncycles or something like that. Thus they change their robots because the strategies get outdated. Well, EPG is exactly the opposite of those guys. EPG is a pupil of Parmenides in the trading world (*)

- Risk aversion. Don’t expect to smash big profits to make a living on a Caribbean island drinking cocktails. EPG plays small with the main goal to lose small. Today its current biggest drawdown is lower than 10%, it’s not something planned. The only planned thing is to avoid ruin in order to be able to trade for the next 10 years

(*) This is not a flash new theory of mine, if you read ‘The Universal Tactics of Successful trend trading’ you’ll see a table where the author exposes strategies created on 1.870, 1.900, 1.930!! And still profitable. On top of that, those ones are really really simple ones. Simplicity and Stability at its most.

I won’t lie, EPG pretends to be a boring Darwin. It’s built to be quietly and relentlessly boring.

Sibling

However, on the other side, you can find in Darwinex his older brother DFO who is much much bolder and reckless. It’s looking for the holy grial.

DFO is much more flexible, mutable and I experiment new ideas on it.

Until I don’t find the holy grial I wouldn’t recommend you to invest in DFO.

But Oh boy! When I find it DFO will be king 🙂

DFO is the explorer, EPG is the settler.